Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

Performance Q1 2023

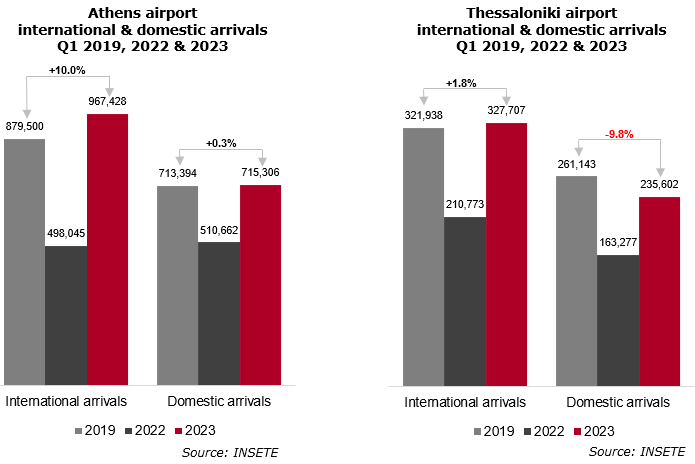

- The international Airport of Athens recorded a significant increase of 10% in international arrivals during Q1 2023 compared to Q1 2019, with domestic traffic at similar levels. Comparing the same quarters for the International Airport of Thessaloniki, international arrivals registered a small increase of 2%, while domestic arrivals declined.

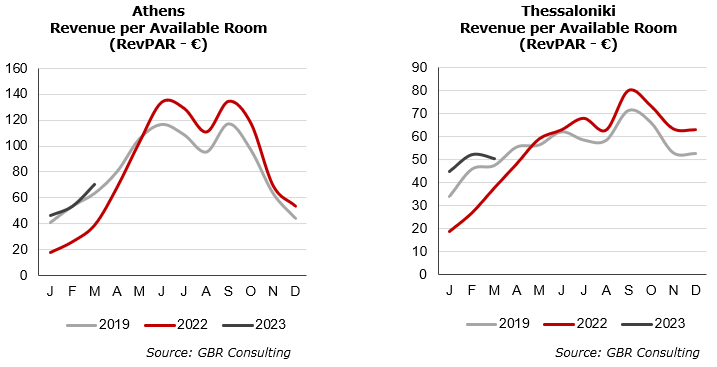

- The increase of demand at the Athens airport is not reflected in the occupancy levels of the Athens hotel sector as declines were recorded comparing Q1 2023/2019. However, as room rates were growing with double digit rates, RevPAR shows a positive start of 2023. In Thessaloniki similar trends are noted.

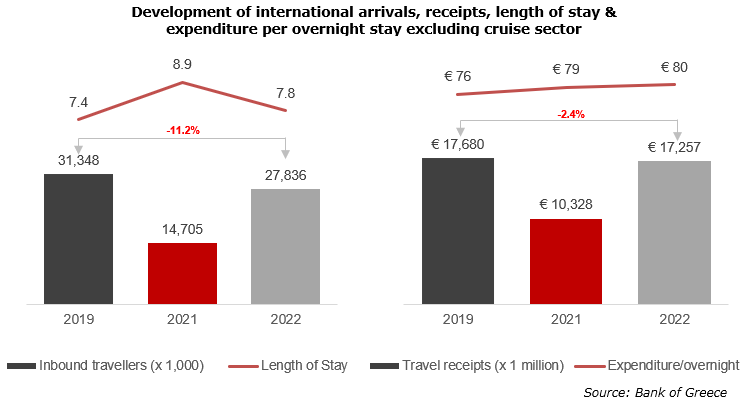

- During the first two months of 2023 the Bank of Greece recorded an increase of 4% in inbound travellers compared the same period in 2019, while travel receipts increased by 9%.

- GBR’s revenue index for the Greek hotel sector, which includes city hotels and a limited number of resort hotels during Q1, recorded for Q1 2023/2019 an increase 9.3%, but a decline of 4.9% in room nights. International arrivals at airports located at the main tourist islands sextupled in March 2023 compared to same month in 2019, albeit at low levels still at nearly 90,000.

Outlook

- In an environment of a significant slow-down of the global economy, geopolitical tensions, inflated energy & food prices and rising interest rates - leading to soaring costs for businesses and households - the Greek tourism sector showed a strong performance in 2022 mainly on the back of pandemic related pent-up demand and accumulated savings, the strong labour market and temporary policy measures worldwide to contain energy costs. The Greek luxury hotel sector registered significant growth in 2022 compared 2019, supported by the return of the Americans. Travel receipts of international business travel to Greece increased by 6.1% in 2022 compared to 2019.

- For 2023, tourism stakeholders are optimistic that this year’s travel receipts will exceed 2019 levels. That being said, all major issues of the sector have come back on the agenda including the further development of infrastructure and implementation of strategies for the sustainable development of the tourism sector taking into account issues with respect to climate change and the energy transition, biodiversity, waste treatment, overcrowding, diversity, equality & inclusion and education. The Greek natural environment and the authenticity of the Greek tourism product must be protected.

- After an unexpected strong Q4 2022, the Greek economy grew in 2022 by 5.9% y-o-y with inflation at 9.3%, unemployment at 12.4% and a primary fiscal deficit that has likely been eliminated as a percentage of GDP according to the Bank of Greece. For 2023 the Bank of Greece is currently estimating a GDP growth rate of 2.2% with inflation expected to reach 4.4% and a primary surplus of 0.7% of GDP. The IMF, in its spring World Economic Outlook report, is more optimistic with GDP growth of 2.6% and an inflation rate of 4.0% for 2023.

- On the other hand, the Bank of Greece also indicated that there are downside risks to this outlook including (1) a deterioration of the external environment due to unfavourable geopolitical developments, (2) a higher and more persistent inflation, (3) a protracted electoral period, which would exacerbate political uncertainty, (4) a lower-than-expected absorption rate of NGEU funds, (5) a halt of reforms or reversal of past reforms, which would impair productivity growth and business competitiveness and (6) the emergence of a new generation of NPLs, due to the interest rate hikes and the impact of the energy crisis, after the gradual withdrawal of the government support measures.

Profile of the Athens Tourist

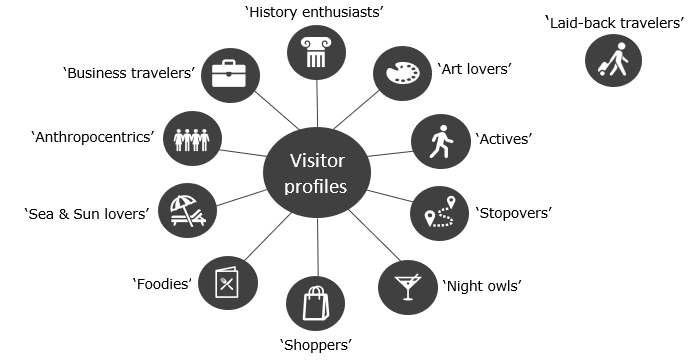

- Analysing behaviour of travellers is complex with many market segments, generations, attitudes, demographics, perceptions, cultures etc. Across all these factors, the annual satisfaction survey conducted by GBR on behalf of the Athens Attica & Argosaronic Hotel Association presented at an event in March 2023 together with the Athens International Airport reveals that groups of Athens’ tourists have common interests. Noting that some travellers have overlapping interests, the research among 2,000 hotel guests in Athens identified 10 specific profiles:

Download here the full 10+1 visitor profiles of Athens in:

- These 10 groups of travellers have travelled to Athens with a specific interest and designed their travel program in the city accordingly. However, a large group, approximately 1/3 of the leisure travellers does not have specific interests. This group goes for a more ‘laid-back’ approach without a fully packed program and the intention to visit as much attractions as possible. On the downside, the ‘laid-back’ travellers feel that they had limited contact with the locals and their way of life. They also spent less than all other profiles, so offering specific experiences increases expenditure. The ‘laid-back’ traveller is very satisfied though with their overall experience in the city with a mark of 8.4 out of 10.

- For ‘history enthusiasts’ who have a great love for archaeology and history, Athens is a must see destination. Of the 10 travel profiles, they spend the least in the city.

- ‘Art lovers’ are inspired by Athens’ architectural wealth, galleries and , museums. An architectural and / or street art tour are often part of the program.

- The ‘actives’ visit as many attractions as possible, go for shopping and visit the Athens coast. They participate often in a bicycle tour and use the hop on hop off bus.

- Athens remains a ‘stopover’ destination for a large group of travellers. They stay on average 1.6 nights, but spend much and are very satisfied with their short experience.

- The ‘night owls’ immerse themselves in the Greek capital of entertainment and nightlife with its many restaurants, taverns, bars, clubs, theatres, festivals and events.

- ‘shoppers’ are visiting Athens for its attractive shopping experience offering a variety of shops, shopping centers and boutiques of all kinds and for all tastes.

- Gastronomy reflects the local culture, heritage and traditions. The ‘foodies’ want to discover new flavours & gastronomic experiences, often by taking part in a tour.

- For ‘Sea & Sun lovers’ a visit to the Athens Riviera, which ranges from Piraeus to Sounion, is a must. Going to the beach and swimming in the sea is a main activity.

- The ‘Anthropocentrics’ are visiting friends and relatives. While a majority stays in the centre of Athens, guests of this segment also stay in other regions of Athens.

- After the Covid-19 pandemic the ‘business traveller’ is returning to Athens. Often combing business with leisure, they are the highest spenders of all traveller groups.

- Despite different interests, all tourists in Athens, including business travellers have the following in common: they usually visit the Acropolis with its Parthenon and the Acropolis museum, in combination with strolling around in Plaka and Monastiraki. That also means that tourism flows are very much concentrated in these areas, which will impact these neighborhoods as the focus is nearly entirely on leisure and entertainment, putting pressure on residents who see the liveability of their neighborhoods decreasing.

- Also the hotel sector is concentrated in an area from Koukaki, to Syntagma Sq., Omonia Sq and Monastiraki. About 72% of all hotels in mainland Attica is located in Central Athens in 2022 and the number of hotel rooms in the centre increased by 19% during the period 2015 – 2022. The number of units in the Short Term rental market in the centre increased by a CAGR of 60% during the period 2015 – 2019 followed by a decrease of the number of units in operation during 2020 and 2021, and a recovery in 2022.

Main transactions

- In February 2023 media reported that interests of Irish businessman Paul Richard Coulson has acquired the 4-star 214-room AKS Porto Heli and the 4-star 220-room AKS Hinitsa Bay. The latter was fully renovated pre-covid and includes a large capacity conference center. The deal has been confirmed by the company. Media reported an amount of € 50 million for the transaction.

Paul Richard Coulson is the largest shareholder and chairman of Ardagh Group, a producer of glass and metal products. In 2022 he acquired Tassos Alexiou SA which includes a plot of land located between the AKS Hinitsa Bay and Kosta, a small resort with a port connecting to Spetses. The property is known for its private airport with a 700 metres runway, which was built by Tassos Alexiou. The airport operated during the 60s and 70s, but was closed by the Civil Aviation Authority in 2004.

- In January 2023 Invel Real Estate and Prodea Investments announced the acquisition of the 5-star White Coast Pool Suites hotel located on the island of Milos. The hotel has been acquired by Prodea Investments (49%) and Invel Real Estate (51%) through its discretionary fund “Invel Eudora Fund 1LP” (“Eudora 1”). Media reported an acquisition price of € 14.85 million.

Currently, the hotel offers 30 suites and as from this season it will be operated by Domes Resorts as an adult-only resort under the name Domes White Coast Milos. The resort will be expanded significantly.

- In September 2022 Intrum Hellas, administrator of the claims arising from loans and credits belonging to the special purpose companies under the names Sunrise I NPL Finance DAC, Sunrise II NPL Finance DAC and Vega II NPL Finance l DAC, announced that a consortium consisting of SMERemediumCap / Latonia Enterprises Company Limited – Athanasios Laskaridis family office / WHG Europe Limited – Brown Hotels were listed as the preferred investor for the sale of a loan portfolio of hotels with a legal claim of

€ 254 million, belonging to the aforementioned special purpose companies (Project Tethys).

Tethys, which is the first sectoral portfolio of loan liabilities sold on the secondary market in Greece, consists of 72 hotel units with more than 4,000 rooms in popular tourist destinations of which 50% are located on Aegean islands (22 units), of Ionian (3) and Crete (11) while the rest in Macedonia and Thrace (19 units), Central Greece (9) and the Peloponnese (8).

The deal has been finalized in March 2023.

|