Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

Performance H1 2022

- On behalf of the Hellenic Hotel Federation, GBR Consulting is tracking 7 million room nights and

€ 1.2 billion in hotel revenue (net) on an annual basis (2019).

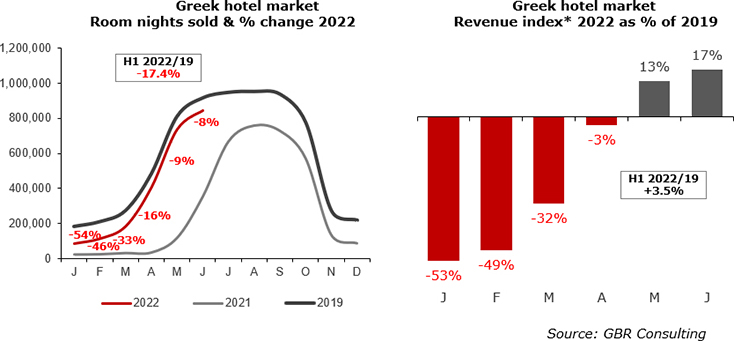

- After a slow start of 2022, demand picked up but with big differences in geographic markets. During H1 2022 the total number of hotel room nights declined 17.4%, while revenue in 2022 outperformed 2019 levels as from May. YTD June 2022 revenue increased 3.5% compared to same period in 2019.

- Resort hotels who in majority started the season in April and particularly May, achieved during the first 6 months of 2022 an occupancy level nearly on par with 2019, or in fact -0.7% lower. However, total revenues increased by 18.6%.

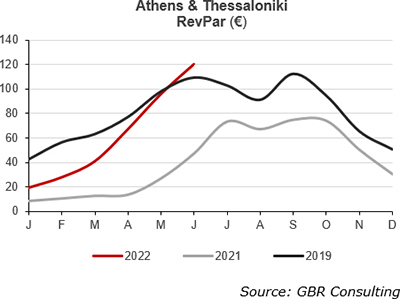

- In Athens and Thessaloniki RevPAR declined 15.5% and 6.1% respectively during H1 2022 compared to H1 2019. During each month of 2022 occupancy levels were lower than 2019 in both cities, while room rates improved during Q2 compared to 2019.

- A similar trend is noted for city hotels outside Athens and Thessaloniki, where occupancy levels with the exception of May were lower so far than the months of 2019. Also, total revenue was significantly lower in 2022 than 2019 during the period January – March, but recorded higher levels in May and June.

Strong Greek air traffic performance during H1 2022

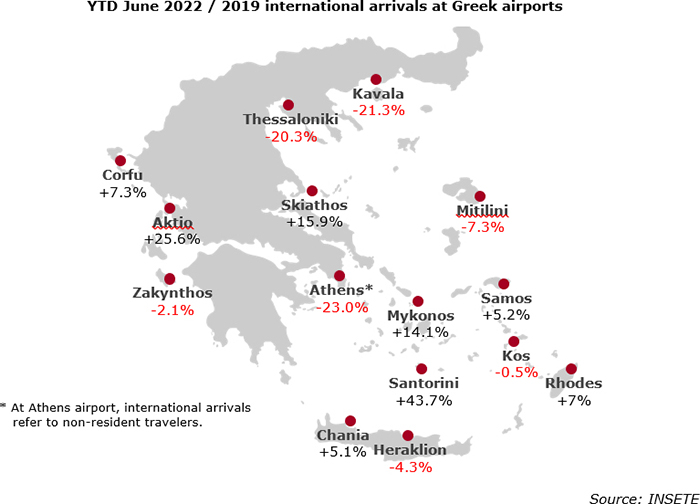

- During H1 2022 the airports of Santorini and Aktion airports recorded the highest increase in terms of international arrivals of 44% and 26% respectively compared to the first half year of 2019.

- Due to a very weak first quarter of 2022, the airports of Athens and Thessaloniki recorded a decline during H1 2022 of 23% and 20% respectively compared to H1 2019.

- On a regional basis, the Cyclades registered +30.5%, the Dodecanese +4.5%, Crete -1.7% and the Ionian Islands +5.5% during the review period compared with 2019.

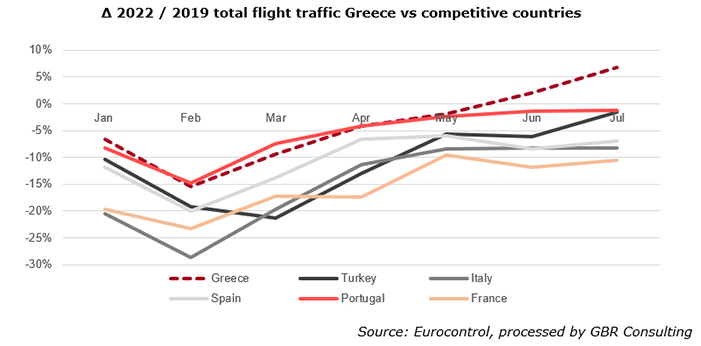

- In terms of total flight traffic (international and domestic), Greece outperformed its competitors with increases in June and July 2022 of 2% and 7% respectively compared to same months of 2019 based on data of Eurocontrol.

- YTD July 2022, total traffic in Greece was nearly on par with 2019 (-0.8%), while France recorded -15%, Italy -14%, Spain and Turkey -10% and Portugal -5%.

Clouding European macroeconomic outlook

- According to first estimates of Eurostat inflation in the Eurozone rose to another record high of 8.9% in July, up from 8.6% y-o-y in June with energy and food prices being the main drivers. Despite easing supply bottlenecks and weakening demand during H2 2022, it is likely that inflation has not reached its peak, keeping pressure on the ECB to hike interest rates. Supporting argument for the persistent price pressure is the very tight labour market, potentially causing a wage price spiral.

- Meanwhile, the resignation of Draghi as Italy’s Prime Minister means that the country is without a fully functioning Government until snap elections in September. Depending on the outcome, financial markets could again question Italy’s fiscal sustainability, already noted by rising bond yields. However, the ECB has created a new bond buying tool called TPI, Transmission Protection Instrument, which enables policymakers to react to any market pressure on member states other than that caused by changes in the economic outlook.

- Gas prices have increased substantially recently due to reduced supplies from Russia, while gas rationing this winter appears increasingly likely. As a result, economic activity is expected to slow sharply towards the end of this year with GDP growth forecast in the Eurozone slashed to only 1.1% based on Oxford Economics estimates, with winter quarters showing a stagnation in activity.

- During H1 2022 preliminary data of Eurostat shows that expectations have been exceeded with a GDP growth during Q2 2022 of 0.7% in the Euro area and 0.6% in the EU compared with previous quarter. However, Germany – Europe’s no. 1 economy – stagnated (0%).

- Inflation in Greece is expected to have reached 11.5% in July based on Eurostat estimates, down from 11.6% in June. GDP growth for this year is robust with a strong tourism sector and is a relatively strong performer among Eurozone economies. However, Oxford Economics projections for GDP growth in 2023 were adjusted to 1.4% as a result of the energy crisis and the related clouding of the European outlook.

- Europe is exposed to global risks which includes scenarios for a prolonged and / or escalating war impacting further energy supplies, inflation and confidence among financial markets and consumers. Also the risk of a reviving pandemic is a global risk with weakening Chinese consumption and disrupting supply chains due to China’s zero Covid policy.

Main transactions

- In July it was reported that the 4-star 275-room Village Resort & Waterpark located in Hersonissos, Crete was sold to Cretan Investment Group Hellas – CIG Hellas, led by Martita Karatsi, who has established a presence in the tourism sector with MK Hotel Collection. CIG Hellas acquired its first hotel in November 2020 from the AKS Hotel Group, currently operating as the 5-star Sentido Unique Blue Resort , also located in the regional unit of Heraklion (see Newsletter

2020 Q4).

- On July 18th 2022 the Hellenic Republic Asset Development Fund officially handed over the Xenia Kythnos hotel to investors Michal and Avraham Ravid, who signed the right to use the hotel and the two thermal springs for a period of 99 years for a total amount of nearly € 3 million. The project, named Genesis of the Royal Baths of Kythnos, has a total investment budget of € 25 million creating also luxurious villas, suites and an open public park.

- Hova Hospitality on behalf of Primonial REIM acquired the 4-star 381-room Club Med Gregolimano, located in the north of Evia from China based Fosun Group. Hova Hospitality was created in 2021 by Dominique Ozanne and Gaël Le Lay and has already built up a portfolio of 125 assets with a value of € 1.3 billion. In the fall of 2022 a € 20 million refurbishment will commence to upgrade and expand the resort.

- After the acquisition of the Naxos Resort Beach Hotel in December 2021, Attica Blue Hospitality – a 100% subsidiary of Attica Group, acquired the Tinos Beach Hotel in July 2022. The total transaction for the 4-star 180-room hotel was € 6.5 million. The new owners are planning to upgrade the resort.

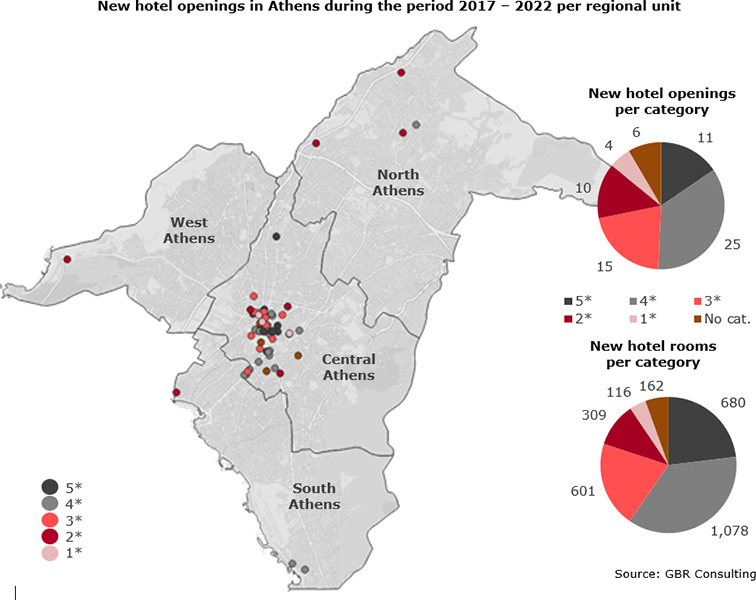

Athens hotel sector 2017 – 2022: 71 new hotel openings mainly in Central Athens

- In the period 2017 – 2022, 71 new hotels

opened in Athens (Central, South, North and West Athens).

- These new hotels represent 20% of all hotels and

14% of all hotel rooms in Athens.

- 83% of the new hotels are located

in Central Athens.

- Most hotels were added in the 4-star category.

- In the 5* category, 32% of the hotels, and 12% of the hotel rooms are new in Athens.

- In Central Athens 22% of the hotels and 14% of the rooms are new.

- Finally, below we have included a detailed analysis of the 5 and 4 star categories on how supply was increased during 2017 – 2022 considering new hotels, category upgrades & downgrades, hotels that stopped operations and changes in room count of existing hotels.

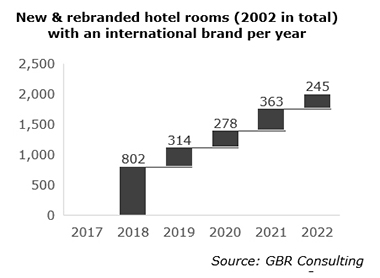

2002 new and rebranded hotel rooms with an international brand added in the period 2017 – 2022

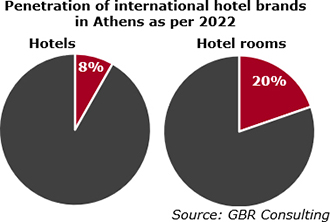

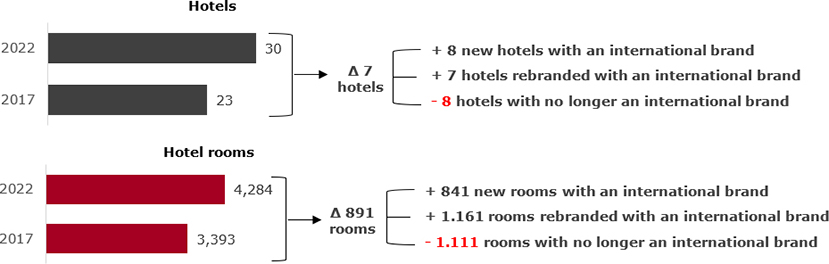

- Currently, 1 out of 5 hotel rooms in Athens, covering Central, North, South and West Athens as indicated on the map above, carry an international hotel brand. About 8% of the Athenian hotels are part of an international hotel chain. In 2017 penetration rates were 17% for hotel rooms and 7% for hotels, noting that supply in the area under review increased significantly.

-

As indicated in the graph below, 8 new hotels opened in the reviewed area during the period 2017 – 2022: the Academia of Athens (Marriott Autograph Collection), Athens Capital (Accor MGallery), Dave Red (Brown Hotels), Ibis Styles Athens Routes (accor), Mocy Athens City (Marrriott), Perianth (Marriott – Design Hotels) Selina Theatrou Athens and Wyndham Athens Residences.

- Another 7 hotels were rebranded during this period with an international brand: Athens Marriott, Brown Acropol, Kubic House & Lighthouse Athens (Brown Hotels), Grand Hyatt Athens and two properties of Convo hotels.

- Please note that properties such as the Four Seasons Astir Palace, Dolce Attica Riviera Ramada Attica Riviera (Wyndham Hotel Group) and Evereden (Vincci Hotels) are outside the reviewed area.

- Finally, 8 hotels no longer carry an international brand comparing 2017 with 2022. These hotels mainly concern the brand Best Western which had 8 properties in Athens in 2017, but only one today. The Athens Hilton is currently closed and is no longer branded as the Athens Hilton. However, the property will return as the Conrad, a brand of Hilton Worldwide, while the residences will be branded by Conrad Residences and Waldorf Astoria Residences. We have included this development in our brand pipeline.

- From the 2002 new & rebranded hotel rooms, most were introduced to the market in 2018.

- About 52% of these rooms are of the 5-star category, 26% 4-star and 14% 3-star. The Selina Theatrou Athens is registered as a hostel.

- Finally, in terms of pipeline we expect the entry of Conrad as mentioned, but also Radisson Individuals (Kolonaki) & Radisson Red (serviced apartments), the Hilton Curio Collection at the former Pentelikon hotel, NYX (Fattal) at the former Esperia Palace, One & Only at the Glyfada Asterias, and international brands at the Hellenikon project.

|