Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

Performance Q1 2022

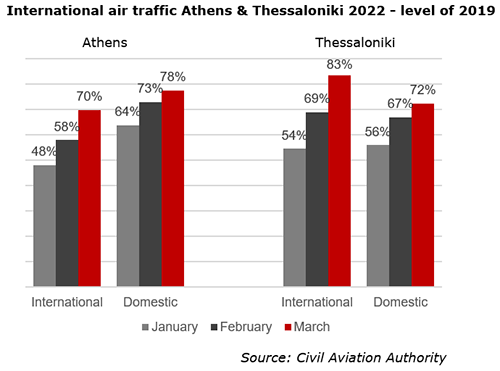

- The cities of Athens and Thessaloniki have commenced their recovery. Domestic traffic at the Athens International Airport is recovering faster than the international traffic, reaching a level of 78% and 70% respectively of 2019 for the month of March.

- In terms of international traffic, the airport of Thessaloniki is recovering faster than Athens reaching in March 2022 a level of 83% of 2019, while domestic traffic reach a level of 72%.

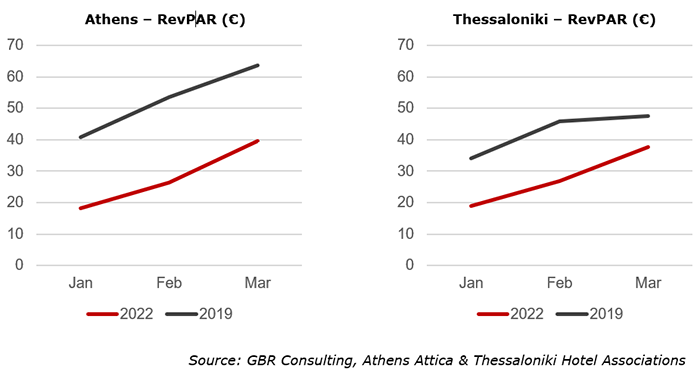

- With traffic picking up in March, the Thessaloniki hotel market registered a RevPAR of 80% of the level of 2019 in March 2022, while Athens reached a level of 62% of 2019 during the same month.

- Overall, both the Athens and Thessaloniki hotel markets achieved a RevPAR of € 28 during Q1 2022. For Athens, that is significantly lower than its international Mediterranean peers of Rome, Barcelona, Madrid and Istanbul. Also, the performance of Thessaloniki stayed behind many international competitive markets with exception of German destinations, who registered low occupancy and room rates during the first quarter.

- City hotels outside Athens and Thessaloniki achieved an occupancy level of around 38% during the first three months of 2022. With respect to resort hotels, few units were in operation during Q1 achieving occupancy levels below 35% on average.

Pipeline Athens and Thessaloniki

- During the pandemic the Athens hotel sector expanded by 32 hotels and nearly 1,600 rooms based on numbers supplied by the Hellenic Chamber of Hotels, the vast majority in Central Athens. Larger hotels that opened include the 100-room Selina Athens Theatrou in August 2020, the 4-star 165 room Brown Acropol (re-opening) in July 2020 and the 5-star 175-room Athens Capital MGallery Collection in September 2020.

- In 2022, not covered by the statistics above, the 3-star Moxy opened and the 4-star Lighthouse of Brown Hotels both at Omonia Sq. with 200 and 220 room respectively.

- Currently around 1,300 new hotel rooms are currently under construction in Attica and another 1,300 rooms are currently under renovation at closed hotel properties. Some properties will carry international brands at re-opening including One & Only, Radisson, NYX, Brown and the Hilton brands Conrad, Curio & Hampton. In addition, as known, about 2,500 rooms are planned at Hellinikon, while many other projects are under investigation.

- In Thessaloniki 4 new hotels opened during 2020 – 2021: the 5-star 83-room Onoma Hotel of the Anatolia Hospitality Group, the 5-star 45-room Vanoro hotel, the 5-star No 15 Ermou hotel with 45 rooms and the 3-star City Gate hotel offering 24 rooms.

- In 2022 the S Hotel opened at the former Olympion City offering 28 rooms and the 5-star 60-room On Residence at the former Olympos Naoussa, a project of the Tor Hotel Group and Grivalia Hospitality.

Pipeline Athens and Thessaloniki

- During the pandemic the Athens hotel sector expanded by 32 hotels and nearly 1,600 rooms based on numbers supplied by the Hellenic Chamber of Hotels, the vast majority in Central Athens. Larger hotels that opened include the 100-room Selina Athens Theatrou in August 2020, the 4-star 165 room Brown Acropol (re-opening) in July 2020 and the 5-star 175-room Athens Capital MGallery Collection in September 2020.

- In 2022, not covered by the statistics above, the 3-star Moxy opened and the 4-star Lighthouse of Brown Hotels both at Omonia Sq. with 200 and 220 room respectively.

- Currently around 1,300 new hotel rooms are currently under construction in Attica and another 1,300 rooms are currently under renovation at closed hotel properties. Some properties will carry international brands at re-opening including One & Only, Radisson, NYX, Brown and the Hilton brands Conrad, Curio & Hampton. In addition, as known, about 2,500 rooms are planned at Hellinikon, while many other projects are under investigation.

- In Thessaloniki 4 new hotels opened during 2020 – 2021: the 5-star 83-room Onoma Hotel of the Anatolia Hospitality Group, the 5-star 45-room Vanoro hotel, the 5-star No 15 Ermou hotel with 45 rooms and the 3-star City Gate hotel offering 24 rooms.

- In 2022 the S Hotel opened at the former Olympion City offering 28 rooms and the 5-star 60-room On Residence at the former Olympos Naoussa, a project of the Tor Hotel Group and Grivalia Hospitality.

- Currently, we have registered about 600 rooms in our pipeline for Thessaloniki including an Autograph and a NYX hotel. In addition, TIF-Helexpo is working on the redevelopment of the entire complex into the ConFex park which will include a hotel.

Recovery at risk due to rising uncertainty

- The conflict in Ukraine is a humanitarian catastrophe which is deteriorating at an alarming scale. Some 5 million refugees have already fled the fighting in the largest exodus the continent has seen since the Second World War and millions more are internally displaced. The greatest numbers have flowed across borders with Poland, Romania, Hungary and Moldova.

- The war is a serious setback to Europe’s strong yet incomplete recovery from the pandemic, which left private consumption and investment well below pre-coronavirus forecasts.

- Oxford Economics still sees the Greek economy growing by 3.0%. Investments are expected to remain resilient during 2022 but also beyond with the support of the NGEU funds of a total of € 31 bn to be spent in the period of 2021 -26.

- The ECB extended the waiver granted for securities issued by the Greek government until late 2024 to be used as collateral for Eurosystem liquidity to banks. This will alleviate some pressure on Greek yields coming from the end of the Pandemic Emergency Purchase Program last month.

Challenges and outlook

- Skyrocketing inflation, 9.4% in April according to Eurostat data, remains the main short-term challenge for the Greek economy, while also other risks are mounting including deteriorating confidence, financial market turmoil and further disruptions to supply chains caused by labor shortages, lack of equipment availability, unprecedented demand, and lockdowns caused by the pandemic.

- The Greek tourism sector has to deal with the same factors with spiking energy and food prices affecting profitability, while severe labor shortages are affecting capacity and quality. Inflation is inflicting a massive squeeze on household budgets among all major source markets, but accumulated excess savings will provide a cushion.

- Despite the slow start of the tourism sector in Q1, compared to 2019 and 2020, the industry is very optimistic for this year with demand picking up significantly as from the end of March at Greece’s main airports at resort locations. After a slower pace during the last weeks of April, the tourism sector will be ready for a significant flow of tourists as from May with the hospitality sector at full capacity.

- At the same time the tourism sector should start refocusing on its future development away from whether or not reaching 2019 levels towards a sustainable industry. Focus will be to increase revenues by investing in the tourism infrastructure, upgrading the product and services, enhancing the skills of tourism professionals & workers and managing & marketing destinations.

Main transactions & developments

- Last month Mitsis Hotels seems to have closed a deal with the Aldemar Group for the acquisition of the 5-star Aldemar Royal Mare offering 435 rooms and the 4-star Aldemar Cretan Village with 322 rooms, located in Hersonisos, Crete

- As indicated in our newsletter of Q4 2022, Mitsis Hotels entered a strategic agreement for the development of the 1,328 stremma at Golf-North Afantou in Rhodes with 3 hotels, a marina and a shopping mall. On the island of Mykonos, Mitsis Hotels is planning a new hotel with 225 rooms and villas in an area of 150 stremma, while in the port of Piraeus a boutique hotel is part of the pipeline.

- In March 2022 the family office of Stavros Efremidis and Delfi Partners Group, announced the acquisition of the Oniro Hotels Group from Treppides Investments & Holdings. The hotels of the group include the Oniro City Hotel in Kolonaki, the Asomaton Hotel in Thiseio, Oniro Suites in Mykonos and a property under construction located in Milioni Street in Kolonaki, Athens.

- In April 2022, Monterock International acquired the 5-star hotel Kenshō Psarou, located in Mykonos, from Notion - Real Estate Development SA. Monterock acquired the shares of Notion’s subsidiary Benestar SA, the company which manages Kenshō Psarou. Media reported an amount of € 19 million. The hotel will be re-opened in May as the N Hotel Mykonos.

- Monterock International is a private equity fund with investments in 16 countries in various industries, including hospitality with the Aman Sveti Stefan in Montenegro and the Aman Canal Grande in Italy in their portfolio. The group is further developing the Nammos brand in various countries and is planning for new Aman and One & Only resorts, while in June the Nobu Hotel and Restaurant Santorini will open.

|