Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

2021 Q1 in review

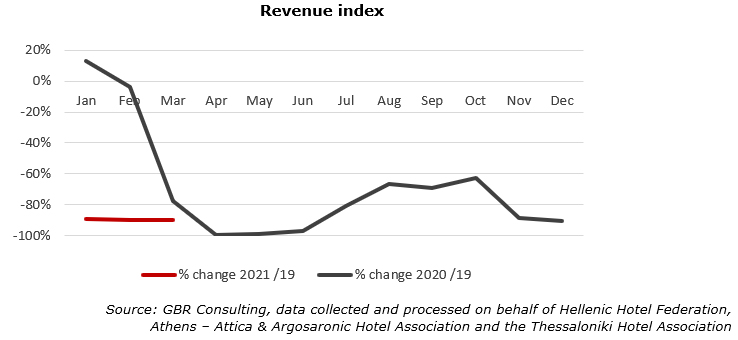

- The hotel revenue index indicated a decline of 89.5% during the Q1 2021 compared to Q1 2019. About 49% of all city hotels in Greece were in operation in Greece during the first quarter, but with hardly any demand, while with a few exceptions the resort hotel sector was closed.

- In Athens only 53% of the hotel rooms were in operation during Q1, achieving an occupancy of 14.5%. Based on Total Room Inventory (TRI), occupancy was only 7.7%.

- In Thessaloniki 46% of the hotel rooms were available in the market during the first quarter of this year registering an occupancy of 17.7%, while TRI based 8.2% was recorded.

- International arrivals at the main airports of Greece were down by 85.7% during 2021 Q1 compared to the same quarter of 2019 according to INSETE. The Bank of Greece registered a decline of 87.9% in the number of inbound travellers during January and February 2021 compared to the same months of 2019, while travel receipts dropped 88.6% during the same period.

Slow vaccinations, travel restrictions & virus spreading delay start of international travel rebound

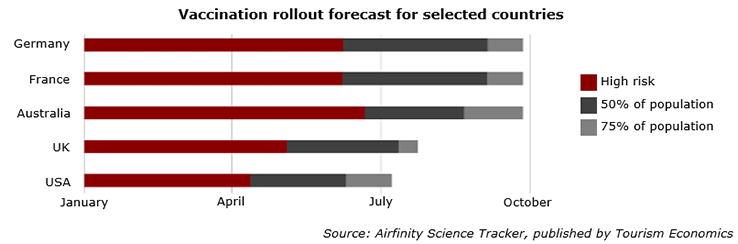

- Widespread vaccination has not been as rapid as expected in December 2020. Airfinity, a science information and analytics company, is predicting as per the beginning of April, that Germany and France will reach a vaccination rate of 75% of population in September of 2021. The UK and the USA, important source markets for Greece, are expected to reach this level this summer.

Virus control in many parts of the world including Europe deteriorated in recent months, while virus variants seem difficult to control leading to even tighter travel rules.

Furthermore, some EU member halted vaccinations with AstraZeneca due to a possible link with a rare form of blood clot. Since then there is also hesitancy under populations with as a result that many doses of the vaccine are not administered. Denmark announced on April 13th the suspension of the use of the AstraZeneca jab.

- Due to these delays and government risk aversions limiting market openings, IATA has adjusted downwards their airline industry forecast for 2021. While in December 2020 it was expected that the global RPKs (Revenue Passenger Kilometers) in 2021 would reach 51% of the level of 2019, in April 2021 this percentage has been adjusted to 43%.

Substantial pent-up demand and accumulated savings will fuel recovery as from H2 2021

- This was seen in March of this year when Germany’s foreign ministry announced that Mallorca was no longer considered a high risk area along with other parts of Spain, Portugal and Denmark. Airlines and tour operators responded immediately and the number of bookings at tour operators for trips to Mallorca surged as displayed below. Compared to week 12 in 2019 sales volume of new bookings ‘boomed’ to 61% in week 11, while a week later the volume was only 24%.

The reason for that was that the German domestic tourist industry reacted angrily, German politicians condemned the Mallorca travel and test obligations were introduced for those returning, while many at the Balearic islands were wondering why the region was welcoming tourists, while residents were still limited by restrictions. In any case, most bookings according to the data were for late summer and autumn, but the appeals from politics clearly had an impact on the bookings.

- Similarly, leisure bookings of the British to the United Arab Emirates jumped after the announcement of the British Government in November 2020 that Brits won’t need to quarantine for 14 days upon their return to the UK.

However, the trend was reversed when a new Covid-19 variant emerged in the UK in December 2020.

- A Moody’s Analytics report of April 2021 mentioned that consumers around the world have stockpiled an extra USD 5.4 trillion of savings since the coronavirus pandemic began and are becoming increasingly confident about the economic outlook, paving the way for a strong rebound in spending as businesses reopen.

Excess saving is at its highest in North America and Europe where lockdowns and government support have been most significant. Those households whose incomes have not been affected by the pandemic have built up savings that they otherwise would have spent on travel, entertainment and eating out. A second factor driving savings accumulation has been unprecedented government support for workers and companies.

Greece to reopen to tourists on 14 May 2021

- Greece is set to reopen for all countries as from May 14th. The decision was made early April in difficult circumstances with the country in lock down. Furthermore, the number of Covid-19 cases were reaching record levels at the beginning of April 2021, about 85% of the available intensive care units are currently occupied and more than 3.1 million Covid vaccines have been administered as per the end of April (29% of the population or 14.5% assuming that every person needs 2 doses).

- However, the number of daily new infections is declining and during the last week of April approximately 48,000 doses were administered each day. For May the Government is aiming to administer up to 2.5 million jabs and up to 4 million in June.

- Ahead of the opening to international tourism, stores and malls are now in operation with restrictions on the number of clients. Greek restaurants, bars and cafes have reopened from May 3rd starting with outdoor dining only, while primary and secondary schools will welcome pupils from May 10th and movement between regions will be allowed again from May 15th.

- German Tour operator Tui responded immediately to the re-opening announcements and will resume flights to Crete on the same day with departures from six German airports to Heraklion in Crete and flights to Kos, Rhodes and Corfu on the next day (May 15th). Also FTI will resume holidays on the Greek islands on May 14th.

- Meanwhile, the EU’s "Digital Green Certificate" is on track to be rolled out in June after a piloting phase in May. The certificates are intended to facilitate free movement by providing proof that a person has either been vaccinated, received a negative test result or recovered from the virus. Greece is part of the first group to test the system.

- However, considering the epidemiological situation in major source markets and the various obstacles that still exist internationally and domestically, a substantial flow of tourists may not be expected before July.

Transactions and main developments

- The Derveni family, which owns Skiathos Palace, acquired the Alkyon Hotel, a 3-star property offering 89 rooms and 5 suites. As from 2022 the new owners will fully renovate and modernize the hotel in order to reopen as a 4-star hotel, with the prospect that one of its wings will operate during the winter months.

- At the beginning of April 2021 Grecotel Hotels & Resorts announced the acquisition of 5 resorts in Mykonos and Corfu for a total amount of € 61 million. The hotels acquired are: Mykonos Star and Mykonos Thea in Agios Sostis of Mykonos and Nostos, Vassilia, Gelina and the Hydropolis Aqua Park in Corfu with a total capacity of 1,800 beds. According to press reports an additional

€ 43 million will be invested for renovation and expansion.

- The Kourtidis Group is planning the Alexandrou Chora project with a total budget of € 50 million, featuring 3 sections: a) the Alexadrou Chora Resort with two 5-star hotels with a total of more than 300 beds, b) the Alexadrou Chora Village with 280 units and c) the Alexander Theme park. The project, which covers a total area of 175,000 sqm, will be located at the beach of Ofriniou (known as Tuzla) in the prefecture of Kavala.

|