Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

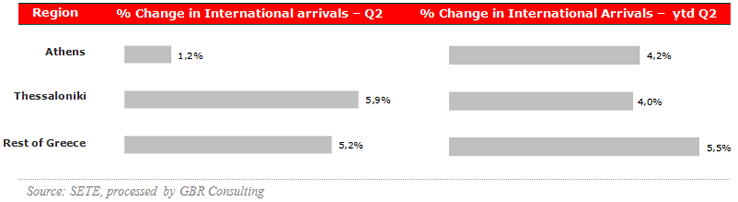

International arrivals1 at Greek airports, 2016 compared to 2015

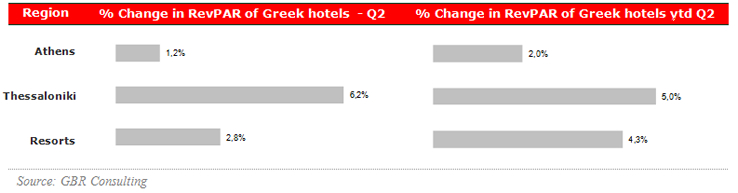

RevPAR2 in Greek hotels, 2016 compared to 2015

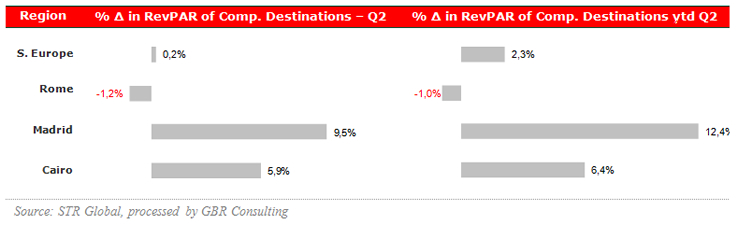

RevPAR in Competitive Destinations, 2016 compared to 2015

Commentary

- The continuous growth of international tourist arrivals at the Athens airport from May 2013 has come to an end in April 2016, when a drop of 1.2% yoy was recorded. As a result, occupancy levels dropped from February 2016, but due to mild increases in room rates, RevPAR improved with 1.2% in Q2 2016.

- In Thessaloniki international arrivals at the airport increased 6.2% during Q2 2016, which had a positive effect on occupancy levels in the city, while room rates mildly increased. Up to June 2016 RevPAR improved 4.8%. However, the crisis in Turkey will affect tourism flows from Turkey to Thessaloniki and to Greece in general. For Thessaloniki the Turkish market is the second major source market after Cyprus in terms of overnight stays on the basis of 2015 data and latest available data of H1 2016.

- Overall, resort hotels have performed well so far during H1 2016, but there are major regional differences. Lesbos has been severely affected by the negative image of arriving refugees, but even though the situation has calmed down, tourists are staying away this year as indicated by the drop of 63% yoy of international arrivals up to June 2016. The island of Samos recorded a drop of 39% and Kos a drop of 18% over the same period.

On the other hand the 4 airports of Corfu, Zakynthos, Kefalonia and Aktio serving the Ionian islands recorded an increase of 10% in international arrivals up to June 2016 compared to the same period last year, while Crete received 11% more international arrivals, Rhodes 8% and Santorini & Mykonos together 16% during H1 2016 compared to last year.

- Internationally, Madrid continues its positive course with an improvement of its RevPAR of 9.5% during Q2 2016, while Rome showed a small drop in RevPAR of 1.2% during the same quarter, as demand weakened from May onwards and in June room prices started dropping.

Cairo was on a track of recovery, even though the tourism industry in Egypt as a whole is severely affected by the attack on a Russian plane leaving the town of Sharm el Sheikh in October last year. However, the crash of an Egypt Air flight from Paris to Cairo in May 2016 and the hijacking of another Egypt Air flight from Alexandria were another major blow to the country's tourism sector including Cairo, which recorded a drop in occupancy of 28% yoy this June.

Instability affecting tourism

- Due to terror attacks in France, Belgium, Turkey, Egypt and recently Germany fear among travellers has increased. As a result the Mediterranean countries of France, Turkey, Egypt and Tunisia are recording drops in arrivals so far this year, while Spain, Croatia and Portugal are seeing an increase of demand.

- Furthermore, on top of terror fears, the Brexit and the drop of the value of the pound against the euro hit bookings of the British.

- Greece is considered a safe destination, but is affected by the instability in the region overall. International airport arrivals increased by 4.9% yoy up to June so far, but arrivals by road dropped by 7.4% in the same period. Data of the Bank of Greece shows that total inbound traveller flows decreased by 1.3% causing a drop in travel receipts by 6.2% in the period January – May. The average expenditure per trip over the same period dropped by 5.7%. On the positive side, we note that the number of Russians and Americans travelling to Greece increased by 48% and 26% respectively up to May 2016, while expenditure increased by 9% and 8% respectively over the same period.

Outlook

- It is unclear how H2 of 2016 will develop as there are many uncertainties. According to SETE some major airlines schedule a reduction of the number of seats on some Greek destinations for 2017.

- In addition, increased taxation will impact the competitiveness of the Greek tourism product. The standard VAT rate increased from 23% to 24% as from 1 June 2016 and two groups of islands have lost a reduced VAT for tourist accommodation and are now paying 13%, like the remainder of the country.

- Finally, as per January 2018 an accommodation tax will be imposed as part of the austerity package passed in May, which will consist of a levy of € 0.50 - € 4 per roomnight depending on the hotel category.

Successful first programme review, GDP will contract 1.2% in 2016

- The first review of Greece's third bail-out programme has been concluded in June, after the government made concessions in a number of areas that had long been resisted. This will offer some respite from the uncertainty that has weighed on the economy since the start of the year. However, Greece is facing a very substantial fiscal consolidation this year and next. Oxford Economics now forecasts that GDP will contract 1.2% this year and will remain flat in 2017.

- Following the outcome of the first review, the ECB reinstated the credit rating waiver on Greek government bonds used by the bank as collateral in the ECB's refinancing operations. This will significantly ease banks' funding costs, contributing to an easing of financial conditions for the wider economy.

New openings

- On 20 July 2016 the 5 star 83-room adults-only, beachfront Domes Noruz has opened in Chania, Crete. Like the Domes of Elounda, another property of Ledra Hotels and Villas, the hotel has joined Autograph Collection making it the second property of Marriott in Greece. The hotel, with a total investment of € 15 million, has 57 rooms with private mini pools, 5 villas with private pools and 21 rooms with an outdoor Jacuzzi.

- On 28 July 2016 the 111-room Athens Tiare Hotel has opened its doors at Omonia Sq in Athens. The property, the former 2 Fashion Hotel, is leased by Mage Hotels and Resorts for 40 years. Earlier announcements mentioned the name Athens Tiffany Hotel.

- Beginning September the 5 star 216-room Electra Mitropolis will open at Mitropoleos St close to Syntagma Sq.

New openings

- According to market sources Alpha Bank received only one bid for the 506-room Athens Hilton from a partnership of Tempes, an investment vehicle controlled by the Konstantakopoulos family and Turkey based Dogus Group. The latter is already participating in a consortium lead by Jermyn Street Real Estate Fund IV LP to operate and develop the Astir Palace Resort in Vouliagmenis. The Greek Council of State has approved in July the amended plan. At the end of 2015 Dogus acquired a property that formerly housed the Canadian Embassy in Kolonaki for a sum of € 4 million.

- The auction scheduled for 13 July 2016 of the 314-room Athens Ledra Hotel has been postponed to September this year as no bidders were interested in the starting price of € 48 million or € 153,000 per room. The hotel was forced to shut down in May due to € 6.5 million debt to Alpha Bank.

- The Hellenic Republic Asset Development Fund (HRADF) announced in July that it will launch a tender for the sale of the 134 room Iniochos hotel. The 3 star property is located near Omonia Sq in Athens and comprises a ground floor, mezzanine, 9 upper floors and a rooftop space.

- In May 2016 HRADF sold the 25-room Leto Hotel in Mykonos for € 16.9 million to the Douzoglou family. The 4 star hotel was built in 1952 and has an excellent location at the old harbor.

- In June an MoU was signed between a consortium led by Lamda Development and HRADF for the sale and long-term lease of the old Athens airport of Elliniko. The MoU signing was demanded by creditors as a prior action of the first bailout program review. .

Endnotes

1 The international arrivals statistics are based on SETE calculations compiling the data from 13 major airports of Greece, representing 95% of foreigners' arrivals by plane in Greece and 72% of total foreigners' arrivals. Thessaloniki airport does not distinguish between arrivals of Greeks and foreigners.

2 RevPAR : Revenue per Available Room; for Greek resorts, calculations are based on TRevPAR (i.e. Total RevPAR). |