Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

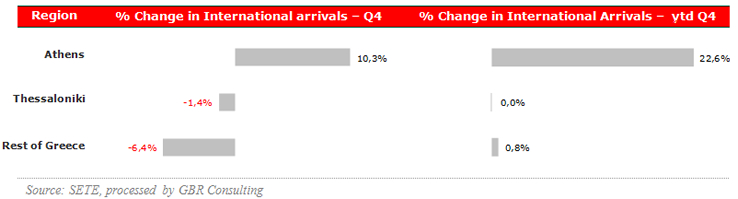

International arrivals1 at Greek airports, 2015 compared to 2014

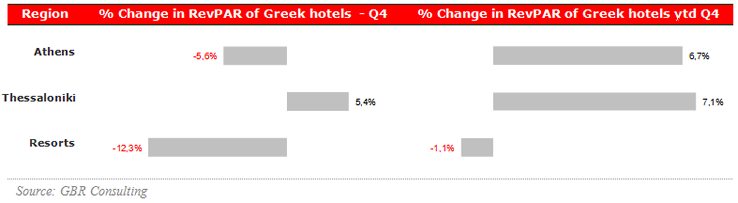

RevPAR2 in Greek hotels, 2015 compared to 2014

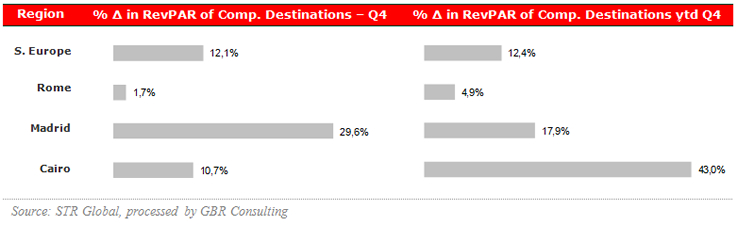

RevPAR in Competitive Destinations, 2015 compared to 2014

Commentary

- The number of international arrivals at the Athens International Airport increased significantly by nearly 23% in 2015 compared to a year earlier. However, many tourists directly traveled to the Greek islands without an overnight stay. Therefore occupancy levels at Athenian hotels increased marginally, also due to a significant growth in 2015 of the number of apartments on peer-to-peer networks such as AirBnB. Thessaloniki received at its airport the same number of arrivals in 2015 as a year earlier, leading a mild increase of occupancy levels, while ADR improved strongly.

- The performance of other major airports was mixed. Arrivals at airports in the Dodecanese dropped by 2%, in Crete by 0.8% and in Kalamata even by 20% yoy in 2015. Mykonos and Santorini increased their total international arrivals by 15% and Zakynthos and Kefalonia in the Ionian Islands by 4% yoy in 2015. Total Revenue per Available Room at resort locations dropped by 1% in 2015 compared to 2014.

- Overall 23.8 million tourists visited Greece, spending € 13.6 billion (excluding cruise passengers). For 2016 mild increases in arrivals of 2% – 5% are expected, while the economy overall continues to suffer.

Greece back into deep recession

- With the political turmoil of 2015 behind us, the Greek Government currently proceeds with the implementation of the three year adjustment program agreed in August 2015. Many of the required measures have already been voted on by parliament, but a number of main issues still need to be negotiated including the break-up of the electricity monopoly, a resolution of non-performing loans and reforms in the pension system.

- The current government forecast is for GDP to decline by just 0.7% in 2016, but given the scale of the fiscal consolidation and the impact of the reforms, Oxford economics forecasts that GDP will fall by 1.6% in 2016 and will remain broadly flat in 2017.

Major deals in the tourism sector

- At the end of December 2015 the Hellenic Republic Asset Development Fund (HRADF) and main stakeholder National Bank signed a new agreement with Jermyn Street Real Estate Fund IV LP for the concession of the Astir Palace Resort at the Athens Riviera in Vouliagmeni. The original plan submitted by Jermyn in 2014 involved the development of up to 100 residential units, but was rejected by the Council of State. The new plan, which has the same total value of € 400 million, includes the development of only 13 luxury villas. The existing Arion & Westin hotel will be upgraded to 6 star hotels. The new amended Special Zoning and Spatial Plan (ESHADA) will be submitted in H1 2016 and the contract with Starwood, which ends in February 2016 will be likely renewed.

- A consortium of German airport operator Fraport, Germany's biggest airport operating company, and Greek minority stakeholder Copelouzos Group signed in December 2015 a 40-year concession with HRADF to operate 14 Greek regional airports. The deal involves an initial concession fee of € 1.2 billion to be paid on the deal's formal closing, expected in autumn 2016. In addition, the consortium has committed to a fixed annual concession fee, initially set at € 22.9 million. It has also committed to investing € 330 million by 2020 in modernizing and expanding the airports, with additional investments to follow in subsequent years to maintain and expand capacity as needed.

- At the beginning of January 2016 Sani Resort SA and Ikos Resorts, announced a merger with the participation of Oaktree Capital Management, Goldman Sachs Asset Management and Hermes GPE. The new scheme will upgrade and expand the 6 existing hotels all located in Halkidiki in the coming two years and will roll out new resorts across Greece in the next 5 years. The investment budget totals up to € 200 million according to press reports.

Investment activity in the Athenian hotel market

- In October 2015 Domotel Kastri started operating 86 rooms in the 5 star category in the north of Athens and Coco-Mat Hotels and Resorts opened in December 2015 a new 39-room 4 star hotel in Kolonaki. Another Coco Mat hotel is planned for 2017 in the area of the Acropolis Museum. Earlier in 2015 a number of small boutique hotel have opened in the centre of Athens including Athens Inn (22 rooms) in September, Ambrosia Hotel (23 rooms) in June, Athens Status Suites (20 rooms) and AthensWas (21 rooms) in April and Emporikon Hotel Athens (14 rooms) in January.

- In 2016 Electra Hotels will open its new 220-room 5 star hotel at Mitropoleos Str. at the former ministry of Education. In February a small boutique hotel The Zillers will open in the same street and nearby the Met 34 with luxury apartments. Furthermore, the former fashion House Hotel on Omonia Square has been leased for 40 years by Mage Hotels and Resorts and will open towards the end of April 2016 as the 4 star Athens Tiffany Hotel. It also seems that a tender in December 2015 for the lease of the Athens Lycabettus hotel in Kolonaki was successful after earlier attempts failed, but names have not been disclosed yet.

- Furthermore, Dogus Holding Group, through its subsidiary MK Mykonos Hotel Company SA, acquired a property that formerly housed the Canadian Embassy in Kolonaki for the sum of € 4 mn and is investigating new uses. The owners of the 262-room Athens Imperial, which closed down in 2012, are in discussion to lease the property. The Ifantis Group, through its subsidiary Athens Holiday SA, which operates the Fresh Hotel, is investigating a new hotel in the former Pindaros Hotel, located in a historic building in Sophocleous Street. And in Piraeus Mektima SA is investigating the conversion of the former Metaxa spirits production location into a 100 room 4-star hotel.

- Finally, we should note that Alpha Bank is still looking for interested buyers for the 506-rooms Athens Hilton. In 2014 Oaktree Capital and Jermyn Street Real Estate were interested to acquire the hotel from Alpha Bank's subsidiary Ionian Hotel Enterprises for around € 180 mn and also businessman John Cassimatidis was interested according to press reports, but a deal was never completed. Recent serious interest has come from Blackstone and Fosun for a price of between € 160 – € 170 mn

Privatisations in progress

- HRADF is currently in the process privatising a 370m beachfront property of 160,000 m2 in the area of Possidi on the Kassandra peninsula in Chalkidiki as well as a property of 627,000 m2 in the area of Porto Heli in the Peloponnese.

- In addition HRADF is proceeding with auctioning a number of properties, including the Lito Hotel in Mykonos, which attracts much interests, due to its excellent and unique location at the old harbour. The 4 star hotel has 25 rooms and was built in 1952. The bidding ends on 31 March 2016

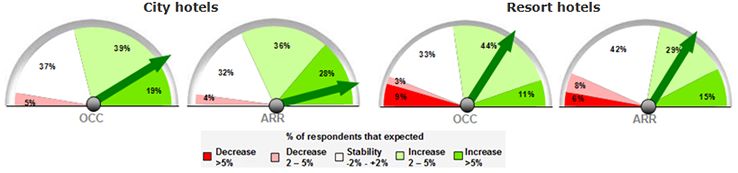

Barometer

- Hoteliers are very optimistic for 2016 according to the GBR Consulting barometer for 2016. Around 6 out 10 city hoteliers is forecasting improvements in occupancy levels and room rates of at least 2% in comparison to last year. The resort hoteliers are slightly more cautious, but also their barometers show a positive outlook for 2016 with increases in occupancy and ADR levels.

Expectations for 2016

Endnotes

1 The international arrivals statistics are based on SETE calculations compiling the data from 13 major airports of Greece, representing 95% of foreigners' arrivals by plane in Greece and 72% of total foreigners' arrivals. Thessaloniki airport does not distinguish between arrivals of Greeks and foreigners.

2 RevPAR : Revenue per Available Room; for Greek resorts, calculations are based on TRevPAR (i.e. Total RevPAR). |